[fusion_builder_container hundred_percent=”no” hundred_percent_height=”no” hundred_percent_height_scroll=”no” hundred_percent_height_center_content=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”no” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”0px” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”4%” padding_right=”” padding_bottom=”” padding_left=””][fusion_builder_row][fusion_builder_column type=”1_4″ layout=”1_4″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”large-visibility” class=”” id=”” background_image_id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius_top_left=”” border_radius_top_right=”” border_radius_bottom_left=”” border_radius_bottom_right=”” box_shadow=”no” box_shadow_vertical=”” box_shadow_horizontal=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_widget_area name=”avada-blog-sidebar” title_size=”” title_color=”” background_color=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” /][/fusion_builder_column][fusion_builder_column type=”3_4″ layout=”3_4″ spacing=”0px” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”no” class=”” id=”” background_image_id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius_top_left=”” border_radius_top_right=”” border_radius_bottom_left=”” border_radius_bottom_right=”” box_shadow=”no” box_shadow_vertical=”” box_shadow_horizontal=”” box_shadow_blur=”” box_shadow_spread=”” box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”15px” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.1″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

VivaColombia Airlines

In 2007 the idea of bringing a low-cost-carrier (LCC) business model to Colombia was born. VivaColombia was the Stanford University’s project of one of its founders, William Shaw (former British Airways CEO), who brought in Juan Emilio Posada (former Avianca CEO), Fred Jacobsen (former Tampa Cargo CEO) and Gabriel Migowski (former Brazilian Air executive) to realize this idea and turn it into a business. Needless to say, the four of them had the combined experience needed to create this company and after much discussion, they all agreed to fulfill that demand in Colombia. Founded initially in 2008 under the name Fast Colombia, the VivaColombia went through various hurdles[1] until May 2012 when they finally began operations in Colombia.

VivaColombia: The Challenge of Growing a Low-Cost Airline in Latin America

The VivaColombia case narrates the airline’s history from 2012 to 2015 at which point the company’s board of directors had to make a decision: whether to expand to a new market in Brazil or go forward with consolidating their local operations to improve standards, consistency of service and customer satisfaction. Both projects involved an upfront cost of $1 Million. This decision had to be determined in the board meeting on December 29, 2015.

The board members of the airline had different opinions of what the best course of action was, but they all agreed that whichever decision was made had to comply with the following four points:

- They would only do one of the two projects

- They didn’t want to incur in higher debt

- Whichever plan had to begin in 2016[2]

- Whichever project had to yield a minimum rate of return of 8%.

Analyzing VivaColombia’s Operations Strategy

(Using Frances Frei’s “4 Things a Service Business Must Get Right”)

The Service

The low-cost airline service models are very straight forward. Their value offering stands from stripping the most out of expenses to then push on those savings to the customer. At the same time, it is imperative for VivaColombia to be transparent about the fact that they are a low-cost airline and what that means to a consumer. Their website makes the charge structure clear with disclaimers that other fees can be included in the final. They are straight forward with their offering: “We’ll take YOU there as cheaply as possible.” That offering comes with the full and sole intention of what YOU mean. Not to be confused with YOU and some luggage, nor YOU in addition to some in-flight catering services.

After the customer purchases the service, an a-la-carte pay per service experience takes over in which the customer chooses to enhance their experience by paying extra fees. For the past decade, the airline industry has been getting smarter about opportunities in ancillary revenue since the hikes of fuel prices in 2007. Ancillary revenue is all the revenue collected by the airlines that are non-ticket related such as early boarding, excess luggage weight, in-flight meals, and entertainment, preferred seat assignment, among many others. In many cases, this revenue has grown tremendously year over year with many airlines doubling their revenue per passenger in the past years. This trend from traditional airlines could be positive for low-cost airlines. In the cheap airline services, customers that genuinely understand the value of the service won’t be alarmed when they are being charged for something extra.

On the other hand, a customer from a traditional airline might be annoyed by the fact that he/she is being charged a fee for something extra since this does not resonate with their perceived value of the service offering. This gives a potential edge in customer satisfaction to the low-cost airlines if and only if the customer understands their offering. Education and transparency will always be an integral part of this service model.

The Funding

To be a low-cost airline, VivaColombia had to differentiate from the traditional airline business model. Some of these differences are[3]:

- Single aircraft type (Airbus A320) – By having a fleet of the same kind of airplane, VivaColombia had savings in the maintenance and technicians needed to support the operations. It also only required regular training for the same aircraft type. VivaColombia on average had half the average amount of employees per airplane in comparison to Avianca and LAN (since they both used Boeing and Airbus Planes).

- Tighter seating and single passenger class – VivaColombia would carry 20% more passengers than the traditional airline in the Airbus A320. The focus on closer seating made no need to create passenger classes since the goal was to maximize the number of people they can fit inside the airplane. Traditional airlines focused on comfort for their customers at a higher price; VivaColombia was not.

- Online Ticket Sales – The majority of their tickets are sold online. They push the customer to finalize their purchase without the help of an employee with the incentive of not being charged with an extra fee. This kind of sales enables VivaColombia to lower the number of needed employees in their front line (i.e., Check-in / Reservation Counter Representative).

- No numbered seats – This strategy makes boarding faster by cutting the boarding time in half. These time cuts result in lower parking and air conditioner cost while the planes are operating.

- No free in-flight services / No frequent flyer program – Traditional airlines provide meals, free entertainment, and rewards for customer loyalty, but this is an expense that VivaColombia forgoes. The airline charges for snacks and drinks in their flights as part of its ancillary revenue strategy. They also don’t have loyalty programs refraining from incurring on those operational expenses.

The funding mechanism for VivaColombia differentiated them from airlines established in Colombia at the time, but they had to focus on getting the funding right because low-cost airline competitors, such as Wingo and Norwegian, had plans enter the Colombian market soon.

Managing the Workforce

The low-cost airline business model leverages some of its funding strategies to manage their workforce. VivaColombia only buys one type of airplane which helps them achieve their workforce by standardizing training for staff and crew. These standards simplify the employee’s experience since they only had to focus on what to do in one aircraft. In contrast, significant airlines send their crew and staff to training where they must learn about various types of aircraft and how to operate in them. Like many other aspects of the low-cost carrier model, managing something becomes a question of simplification and standardizing procedures.

Airlines, in general, share similar tactics for workforce management by offering fringe benefits. The industry has determined that it can fill empty seats with their employees (or their family members) and in this way, they enhance the employee’s experience when there is no way of monetizing that passenger seat. Employees in most airlines have the benefit to fly standby on an airplane with available seats as long as they are flying through internal company routes. Some companies even extend this benefit across airline alliances and partnerships which maximize the profit of the employee, given them the ability to expand the route selection across the partnerships their employer has established. These types of fringe benefits are beneficial to retain personnel that deals directly with the customer. The chances are that if a customer is dealing with issues of their travel, they will most like take out their frustration on the airline employees. Airlines provide this great benefit to the employee with the thought that it will supersede the will to behave inadequately towards a customer.

Managing the Customer

VivaColombia managers its customers through their online platform. Part of the business model has been built in a way that the online platform of the company is the one that faces the customer on most occasions. Their website is very similar to those of low-cost airlines (i.e., Spirit Air, Ryan Air) which have a very distinct feel from the major airlines (i.e., United Airlines, Delta Airlines, American Airlines). The website layout has been designed to be transparent about their pricing and charges that customers can expect. In this aspect, VivaColombia does a good job, but it seems that they completely forget about the customers that don’t read and the ones that are unable to understand the company’s value offering. This is evident when customer satisfaction surveys state that 20% of its customers will not fly again with VivaColombia[4].

Contrary to VivaColombia, a traditional way that significant airlines manage their customers is by providing enhancements to the customer’s experience with offerings such as loyalty/frequent flyer programs. These types of programs help the airlines retain customers by offering them upgrades and perks to their expertise. These experience enhancements further increase customer satisfaction and increase the possibility of repeated business with these customers. On the other side of this experience, if the airline is not able to provide the expected service (i.e., lost flight/seat to overbooking) for a customer, it finds a way to compensate for their shortcomings. It is customary for airlines to provide flight vouchers (for free flights), cash compensation and hotel accommodations if this is what it takes to increase the likelihood that the customer will fly again with that airline after they have failed at providing the expected service.

Positive customer experience is the driver of repeated business in the airline industry. This is the reason why airlines must always strive to increase customer satisfaction by managing their customer’s experience as much as they can control. The intangibility of the airline services makes quantifying the value more complicated when compared to manufacturing operations. Up next, we explore how service firms differ from manufacturing firms and how those differences affect the company’s strategy.

Explaining differences between manufacturing management and service management / VivaColombia and its effect on its service strategy

Airline Transportation Services are partially intangible

The intangibility of airline service makes quantifying its value more complicated since it’s based on the customer’s experience. Airlines rely on sources of information relating to their service to understand how their service is performing such as repurchasing decisions, customer satisfaction scores from company surveys, and also user review platforms (i.e., Yelp!, TripAdvisor). By gathering information about how their customer’s satisfaction can improve their operations to cater to the maximization of that perceived value.

Low-cost airlines have to pay very close attention to the intangibility of the airline transportation service, especially when entering new markets that have never experience the cheap airline model. Paying attention to the customer’s perception of value has to be fundamental to changes that VivaColombia has made since it began operations. As the voice of the customer has come through, they have assimilated that feedback by establishing different fare classes[5] and changes to their reservation system[6] to control and increase customer satisfaction of their services.

Airline Transportation Services Involve Customizations

Airlines, as a transportation service provider, take a high level of customizations to its core offering. One of these service customizations involves setting and providing scheduled flight routes, which in turn potential flyers select after determining their travel plans. For this to be of value, VivaColombia has to be sufficiently flexible to meet the demands of the flyers went to the routes and schedules it offers.

Another aspect of the service that involves high customization is the airline’s a-la-carte enhancements to the flyer’s experience. VivaColombia has an array of improvements that can be added to the reservation for further customization. Some examples of these customizations include priority boarding, seat assignment, meals, drinks, among other perks.

Airline Transportation Services can’t be inventoried entirely

The airline transportation service cannot be made into an inventory entirely. Once the flight takes-off, there is no way to gain revenue from an empty seat inside a flight. Since the services can’t be stored (while preserving value), they have set their eyes in ancillary revenues to maximize their gains. For this reason, airlines have launched revenue management teams intending to maximize the revenue per passenger seat/flights.

Another issue with this aspect of the airline services inventory is relating to flight delays and cancellations. In the case of VivaColombia, they had a relatively small fleet of A320’s, which meant that an airplane that is out of service was detrimental to the company’s operation. On various occasions, flight cancellations and last-minute changes in schedule had broken out into customer protests at the airport. On two of these occasions, Fred Jacobsen (CEO at the time of these incidents) went directly to the airport to speak to the customers hoping that they would understand the issue they were facing. He tried to explain the reality of having one of their airplanes out for repairs, but needless to say the customers did not have it.

Backup airplane fleets are seen in significant airline carriers as the means to hedge against lost revenue. Substituting an aircraft that can’t fly with operational one is one of how major airlines can control for this loss in revenue. It might take the customer longer to get to their destination, but they will get there nevertheless. In the case of VivaColombia, this was not a simple task because they had no backup planes. All their airplanes were being fully utilized with nine A320’s covering 27 routes daily. Lack of backup airplanes have been the cause of VivaColombia’s loss in revenue and in part lead to the recent decision in June 2017 of purchasing 50 new A320’s to improve their fleet size, capacity and operational efficiency[7]. This decision will help the company improve its ability to keep sustaining the low-cost airline model as they keep growing in Latin America.

Airline Transportation Services have customer involvement and co-production

For this service to be delivered, the customer has to be involved in aiding the transaction. This is the reason why service design must always consider customer interaction. In this case, the customer exchanges information with the airline’s online platform (website) to purchase the service. The overall experience the customer has with the airline’s system will determine whether the customer buys or decides not to do so. This is the reason why service firms must take into consideration their customer’s experience when designing and setting up their platforms.

Another way that we can see co-production in airline operations is when the customer purchases a flight from the Airline’s service/reservation desk. In this case, the physical setting increases the complexity of the operation since there is back-room (non-customer facing) variability, front-room (customer-facing) variability in addition to the customer’s involvement in this process. The airlines must have standard methods to deal with these situations keeping in mind the internal and external variabilities of the service.

Service Variability

Service variability comes in an array of forms, each with a different degree of complexity. In this case, we must take into account that the customer is introduced to the service, which in turn adds another level of sophistication and variability to the service. Service variability can come in the form of Arrival, Request, Capability, Effort, and Subjective Preference[8].

In the VivaColombia case, the authors mention of service complaints issues about the company’s rapid growth[9]:

- Poor customer relations – The company was receiving complaints about the way their staff was handling day to day situations.

- Misinformation – The young company didn’t have the experience of dealing with unexpected situations at the airport that was out of their control. That inexperience made the staff singularly unhelpful in these situations which infuriated customers

- Flight Delays and Cancellations – VivaColombia had only nine A320’s serving 21 domestic and six international routes. Airplane repairs and maintenance were the cause of major operational disruptions.

- Need to adapt to a new business model – The airline was having many issues with customers that didn’t understand their service. The customers many times felt mislead by the airline’s additional charges which did not benefit the brand they wanted to establish.

Examples of VivaColombia Dealing with Service Variability

A service firm must always be trying to find strategies for how to deal with their variability. Although the full extent of VivaColombia’s efforts to deal with service variability was not in the case, there was enough public information speaking to new shots from the company.

VivaColombia’s way of managing consistent and standard training was by only using one type of airplane (Airbus A320). Dealing with their service capability variability, they made the training for the staff, crew, and maintenance technicians a very straight forward and standard process. Employees just had to figure out what role they played in one type of airplane. In contrast, major airlines and industry associations have an array of training designed for various aircraft [10], which leads to longer training time and higher costs.

Throughout the first couple of years, VivaColombia came to realize the problem it had with new customers and their understanding of the low-cost service. This leads the company to lower satisfaction scores, and their brand was beginning to be associated with “stealing” from customers with “hidden” fees. This was an example of subjective preference variability in the service. In response to this, the airline decided to rethink their fares, fees, and the ways that they communicated with their customers through their website. This process led to the creation of three different fare classes: Viva, VivaSuper, and Viva Max.

- Viva – includes base fare; only consists of a carry-on bag (“book-bag” size) at no extra cost; does not include airport check-in fee

- VivaSuper – includes base fare; carry-on bag, luggage bag, and fast lane boarding service; does not include airport check-in fee

- VivaMax – includes base fare; carry-on bag, luggage bag, fast lane boarding service, seat assignment, date changes, and airport check-in fee included

An example of how VivaColombia dealt with their request variability was by improving their online reservation’s platform. In June 2016, VivaColombia announced that it had made significant changes to their reservation system[11]. The company decided to migrate its legacy platform to Navitaire’s New Skies Passenger Service System (PSS). These changes in the system enabled the company’s customers to have a better line of sight into their reservations and also gave the customers the ability to make changes to their existing bookings through the website. It also gave VivaColombia the ability to outsource reservation management to Navitaire which moving forward was in charge of handling the global distribution of VivaColombia’s flights[12] in addition to incoming internet and call center reservations.

Outsourcing Services

As mentioned in the previous section, outsourcing services is a way in which some airlines choose to deal with service variability. Low-cost airlines tend to outsource aspects of their operations when the value of outsourcing outweighs the cost of controlling that specific part of their process internally. In the case of VivaColombia outsourcing their reservation management to Navitaire gave the airline more time to focus on other aspects of the business.

On a more general note about the airline industry and outsourcing services, baggage handling services at the airports are usually outsourced to a local service provider. This relationship is vital because of two main reasons: 1) operationally it has to be efficient in loading the airplanes with the adequate cargo; 2) anything that happens to the cargo or luggage will be blamed on the airline and not the third-party company. Outsourcing services can be a double edge sword. They have the propensity to lower costs and deliver high quality, but they can also have an unintended effect in the perceived quality of the customer-facing company (the airline in this case). Companies that outsource services should never turn a blind eye to that aspect of the operation simply because there is another party that is supposed to worry about that. They must consistently ensure the third party’s quality so that it doesn’t jeopardize the airline’s quality by proxy.

VivaColombia Outsources Airplane Maintenance to AAR

Let’s discuss another example of how VivaColombia outsources another part of its operation and its associated risks. In June 2017, VivaColombia (and its sister airline in Peru, Viva Air Peru) signed a multi-year support contract with AAR. AAR supports airlines by providing fleet maintenance and supply chain support (relating to airplane parts). “This contract is the latest example of how AAR’s flight-hour support programs are a perfect fit for fast-growing airlines in emerging markets, in addition to established carriers in major markets,” said John Holmes, President, and Chief Operating Officer, AAR[13].

Efficiencies by Outsourcing AAR

The primary ability in outsourcing this service is in direct and indirect costs. The skills and expertise that AAR brings to both airlines provided them with a high-quality, low-cost solution to their fleet maintenance. Another efficiency that AAR provides the airlines is the purchasing power for the airplane part since they have a bigger pool to purchase for all their entire customer base.

Associated Risks with the AAR Partnership

By outsourcing these services, both VivaColombia and AAR undergo an array of risks of both the supplier and the consumer of the outsourcing service. We can deduce that VivaColombia laid-off or somehow got rid of their fleet maintenance staff once the AAR contract started. The most significant risk that VivaColombia assumes is: what happens if this contract abruptly ends and how would they handle their fleet’s maintenance moving forward if this were to happen. This is a significant risk that VivaColombia decided to assume because the decrease in expenses and the higher quality of work (due to AAR’s expertise) was worth the risk when compared to the risk associated with keeping the fleet’s maintenance operation in-house.

In this particular case, AAR’s risk is based on its investment to establish operations in the client’s country (Colombia and Peru for Viva LatinAmerica), but this can also serve as the foundation of building a customer base in that country. If these relationships don’t work out, capital investments could potentially be lost, and the company’s risk would be fully realized at that point. This type of risk is managed by both parties engaging in a multi-year contract and identifying company champions that will further develop the partnership across both companies. Through these strategies, parties involved hedge their potential losses by keeping a line of sight into each other’s company and ensuring the long-lasting relationship while providing the maximization of the shared benefits.

TripAdvisor Reviews – Pareto Charts and Affinity Diagrams

Online reviews can be an excellent tool for a company to understand some of its strengths and weaknesses. To get an in-depth look into the social sentiment and perception of the firm’s service, a tool was re-engineered to scrape the last 367 English and Spanish reviews available on TripAdvisor.com under the VivaColombia’s user review page[14]. The sentiment split for the reports were: 47% Negative Review (1-2 TripAdvisor Score), 18% Neutral Reviews (3 TripAdvisor Score), and 35% Positive Reviews (4-5 TripAdvisor Score). The date range for this analysis is between August 3, 2016, through March 6, 2018. Unfortunately, the negative sentiment in the company’s reviews has been trending upwards in the past two years[15].

This exercise intends to gain some insights into VivaColombia’s continued efforts to consolidate services to increase customer satisfaction and to lay the groundwork for areas that will be further assessed for quality and process improvement. This will be done by first categorizing all positive reviews to understand the airline’s areas of strengths. Then this will also be done for the negative reviews to identify the most significant weakness that customers see in the airline. Once the weakest category is defined, an affinity diagram will be produced to determine types for a final Pareto Chart. The ultimate focus on analyzing the lowest category will be to make some recommendations for potential improvements.

Positive Reviews

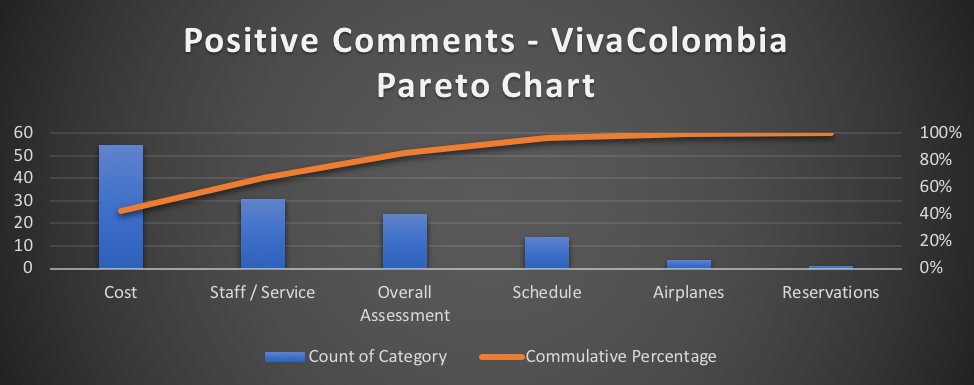

Figure 1. TripAdvisor’s Positive Reviews Pareto Chart

The categories for positive reviews were the following: Cost, Staff/Service, Overall Assessment, Schedule, Airplanes, and Reservations. In the positive reviews, there was enough evidence to support the strength of VivaColombia’s low-cost-carrier business model. The review category of Cost came up as the most frequent in the Positive Reviews (43% of total), indicating that their customers find Cost to be one of the most positive aspects of the airline’s service. There was a constant underlying thought in the Cost Category’s reviews, which hinted subtly to “getting what you paid for.” This was not necessarily in a negative sense, but more like an understanding of the airline’s value offering and having a positive sentiment about that fact.

Negative Reviews

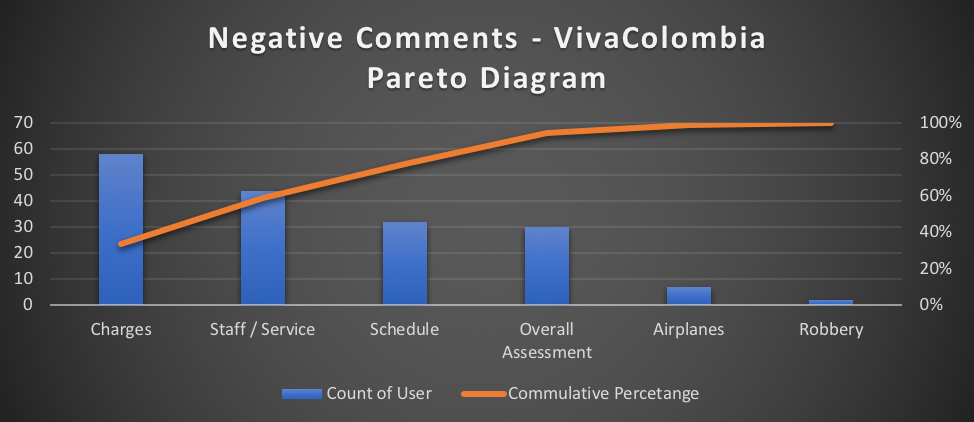

Figure 2.TripAdvisor’s Negative Reviews Pareto Chart

The categories for negative reviews were the following: Charges, Staff/Service, Schedule, Overall Assessment, Airplanes, and Robbery. The results of the negative review’s Pareto Diagram were consistent with various issues detailed in the VivaColombia case. The Charges Category ranked highest in frequency among the negative reviews. According to the case, the company understood that they were doing business in an emerging market where the traditional airline model was the norm. Their customers don’t always understand the model, and when charges are applied, their service satisfaction decreases.

Affinity ideas were generated to understand the nature of the negative sentiment regarding the Charges Category. These ideas were the following:

- Are we communicating our charge structure adequately?

- Do we have to improve the website? Changes to the website

- Do we have a problem with our Check-in procedures?

- Customers feeling mislead

- Standardization of how employees handle charges issues with customers

- Staff communication skills

- Website communication effectiveness

- Are we clear about luggage charges?

The generated ideas fell in the following categories: 1) Check-in procedures; 2) Website; 3) Staff communication; 4) Luggage Charge Issue. Aligning the negative Charge related reviews into these three categories produce the following Pareto Diagram:

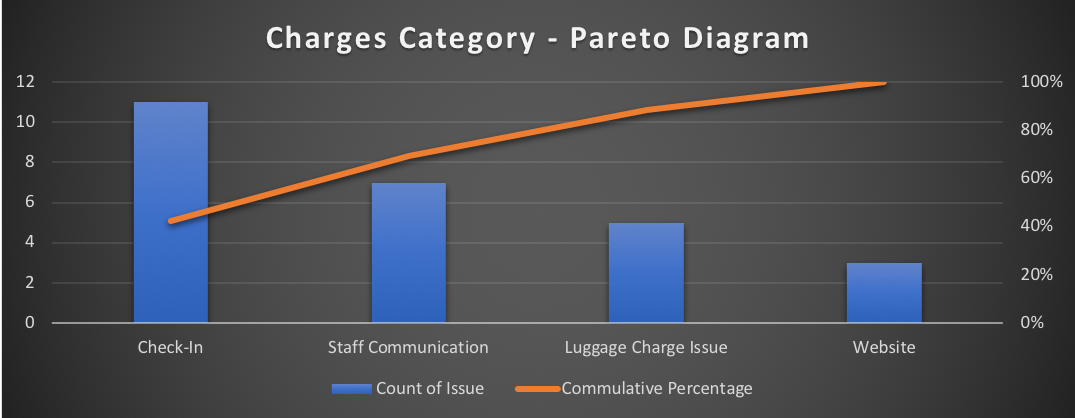

Figure 3. TripAdvisor’s Charges Pareto Chart

Recommendations for VivaColombia Charges Complaints

From the Charges Pareto Diagram, it’s recommended for VivaColombia to look further at their check-in procedures and how their staff communicates with its customers. Over 40% of all charge related complaints had to do with customers being charged an unexpected check-in fee if they printed their boarding pass at the airport. This seems to be an issue of clarity and transparency. VivaColombia states that all potential customer fees are transparent on their website for the customer to see at the point of booking their flight.

Over 20% of the charges complaints had to do with the way that the airline staff communicated with their customers, but the surprising fact of this analysis was that customers were not complaining much about VivaColombia’s website. Although the report doesn’t point to the site as the root cause, it’s most likely an excellent idea to look into it. This is because if the platform should address these soon-to-be complaints, then the chances are that two things might be happening: the company is not communicating its value offering, or the customer is not reading the website information correctly (if at all). This might be the cause of customer complaints regarding staff communication.

Quality and Process Improvement

In the Negative Review’s Pareto Analysis, Staff / Service and Schedule were the next two categories driving negative sentiments, and these should also be addressed by VivaColombia. In the VivaColombia case, these two categories also resonate with the issues that came about their rapid growth.

Model for Quality Improvement

The quality of service can be framed in three factors to assess for potential quality improvements. These three factors are Conformance Quality (how the service is delivered), Performance Quality (what are the customer’s preferences) and Communication Quality (what are the customer’s expectations)[16]. When these factors are assessed individually for VivaColombia, communication quality seems to be a factor that has to be explored further. It seemed evident from the TripAdvisor analysis that the charge structure was not being communicated effectively and causing customer satisfaction to decrease.

When the conformance quality is compromised, it has a detrimental effect on the customer’s expectations. When the customer’s expectations are managed inadequately, customers tend to be disappointed with the service delivered since what he/she gets does not conform to their preferences as a customer. In summary, these three factors of quality are tied together in a continuum where problems usually can be traced back to gaps between them.

Examples of Process Improvement in the Airline Industry

Although quality improvement is an overall part of process improvement, it will be worth to mention that VivaColombia should consider examples in process improvement techniques to reduce expenses and become a more efficient business model. Below are two examples of how the industry has adopted process improvement techniques to improve operational efficiencies.

Improvements to the management of catering inventories

Although many airlines outsource their catering services, these services can have an impact on the airline’s operations and customer experience. Airlines have adopted lean techniques such as making sure their catering is accurate and lowering the time of on-hand inventory to lower down operational costs. An industry example of these powerful techniques adaptations is US Airways. US Airways has “adopted this lean management technique and testifies to its success. According to a representative of the US Airways, the transition to a ‘just-in-time’ production scheme has allowed them to reduce inventory at their five commissaries, improve the accuracy of catering services on the aircraft, and increase the overall consistency of stocking”[17]. Something as simple as having the same employee stock the same drawers improve the quality of the stocking process.

Redefining baggage handling

Auckland International Airport has improved their baggage handling through the use of a simple lean six sigma strategy – as soon as the plane is on blocks, the cargo doors are opened, and the bags are taken out even before passengers have started moving[18]. According to an Auckland International Airport executive, redefining baggage handling has reduced five minutes of off millions of passenger trips which translates to incredible cost savings for the Airport and for the Airlines that operate out of that airport. This process improvement technique can also lower down the cost of parking and air conditioner that airlines incur while the plane is being unloaded while at the same time decreasing the airplanes turn-around time, maximizing the airline’s flight time and declining scheduling issues.

Conclusion

The ending of the VivaColombia case sets the stage around the December 2015 Board of Directors meeting in which the decision on the future path of the company was going to be determined: to expand or to consolidate. Both projects had the same initial capital investment of $1 million and a decision of the path moving forward was to be determined.

The two options

- Option 1: Expanding operations in Brazil is a high risk, high reward future path for the company. VivaColombia had already acquired the necessary permits for the flight routes to Brazil, so starting operations in the country would not have taken long to start operating[19]. Brazil also showed promise as a growing market which allowed VivaColombia to establish itself in the market as the preferred low-cost airline for the Bogota – Sao Paulo route[20].

- Option 2: Consolidating operations locally had a lower risk, lower reward than expanding into the Brazilian market but the efficiencies that would come about consolidation were integral to the company’s ability to develop in the future.

Recommendation

Expanding to Brazil would bring an array of changes to the operations and the business model since they would have to hire more staff in Brazil and also, they would need to purchase a different type of aircraft, the Airbus A350-800 XMB. The need for a new aircraft type was due to plane size. A350-800 XMB had the cabin space and comfort needed for these now long-haul flights from Colombia to Brazil. The experience in an A320 on this long of duration would most likely be dissatisfactory to their average customer. Changes of these nature would further disrupt the business model as they are trying to expand into new markets which could cause a detrimental effect to the Colombia-based operation.

It’s in VivaColombia’s best interest to consolidate operations locally to solidify its market position and help reduce customer dissatisfaction. Market research had shown that by consolidating services, they would reduce their customer dissatisfaction by 15%, which would translate into doubling up their demand year over year for the next three consecutive years. Failure to consolidate would have meant that their satisfaction score would’ve stayed stagnant with increases in demand of 8% year over year for the next three consecutive years. With low-cost carriers coming into the Colombian market, it is imperative for VivaColombia to gain an advantage over the newcomers.

VivaColombia Today

The board’s decision in 2015 was for VivaColombia to consolidate operations locally and to look into other possible ventures that complemented their business goals. VivaColombia went through a great deal of change in a brief period between 2015-2017.

In June 2016, Irelandia Aviation acquired a 50% more equity stake in the company bringing its participation to 75% giving Declan Ryan (founder of Irelandia Aviation) a great deal of power over the company’s path moving forward[21]. The 25% participation left was owned by Grupo Iamsa. This deal went to the founders without equity participation, and in a short period, this would be evident. William Shaw stayed as CEO while Posada and Migowski (two of the founders) left VivaColombia. In August 2016, the company announced plans to operate a low-cost airline in Peru, under the name Viva Air Peru[22]. In 2017, under the Viva LatinAmerica Group umbrella, management decided to outsource their fleet’s maintenance services to AAR[23]. Management was making new decisions to cut costs to gain competitive advantages with plans for expanding operations. William Shaw stayed as CEO of Viva Air until recently, when in January 2018, Declan Ryan took over as CEO of the company. He took the opportunity also to announce that the “carrier continues its major expansion plans following last year’s $5.3 billion purchase order of 50 Airbus A320 aircraft that will begin to be delivered in the second half of 2018”[24].

VivaColombia went from transporting 550,000 in 2012 to over 3.5 million passengers in 2017, and it’s still expected to keep growing. Year over year, this is a company that has gain market share and has expanded its operations internationally with flights to the United States, Peru, and Panama. The airline still has room to grow with the new purchase order of the 50 A320’s as well as improvements to the way they communicate with its customer base. For them to stay competitive, they should always look into ways of reducing their service variability, finding better ways to express their service’s value offering and always look for ways of delivering a higher service quality at a lower cost.

[/fusion_text][fusion_separator style_type=”none” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” sep_color=”” top_margin=”10px” bottom_margin=”” border_size=”” icon=”” icon_circle=”” icon_circle_color=”” width=”” alignment=”center” /][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” class=”” id=””]

Sources/References/Notes:

[1] In 2010, VivaColombia had petitioned the Colombian Aerocivil Authority for the permit to operate the low-cost airline business model in Colombia. The permission was granted in August later that year. The first three Airbus A320 were delivered in March 2012.

[2] The Colombian Aerocivil Authority’s permit allowed only one year to begin servicing new routes after the permit was granted.

[3] VivaColombia: The Challenge of Growing a Low-Cost Airline in Latin America (page 3 – 4)

[4] http://www.semana.com/nacion/articulo/vivacolombia-un-caos-un-modelo-de-negocio/382418-3

[5] See Dealing with Service Variability for more details on the different VivaColombia fares.

[6] https://trafficamerican.com/excelente-sistema-de-reservas-en-vivacolombia/

[7] http://www.airbus.com/newsroom/press-releases/en/2017/06/viva-air-commits-to-50-a320-family-aircraft.html

[8] Breaking the Trade-Off Between Efficiency and Service, Frances X. Frei (2006)

[9] VivaColombia: The Challenge of Growing a Low-Cost Airline in Latin America (page 6-7)

[10] http://www.iata.org/training/courses/Pages/airline-cabin-crew-talg51.aspx

[11] https://trafficamerican.com/excelente-sistema-de-reservas-en-vivacolombia/

[12] Navitaire’s platform included a Global Distribution System (GDS) connecting VivaColombia to all major Online Travel Agencies (OTA’s).

[13] https://www.prnewswire.com/news-releases/aar-signs-component-support-agreement-with-viva-colombia-and-viva-air-peru-300470237.html

[14] https://www.tripadvisor.com/Airline_Review-d10661148-Reviews-Cheap-Flights-VivaColombia

[15] 2016 = 33% Negative Reviews; 2017 = 47% Negative Reviews; 2018 YTD = 69% Negative Reviews

[16] Dr. Phillip Lederer – Lecture #7: Quality & Process Improvement (2018)

[17] https://leansixsigmabelgium.com/blog/ways-lean-airline-companies-improve-their-services/ (direct quote)

[18] https://leansixsigmabelgium.com/blog/ways-lean-airline-companies-improve-their-services/ (direct quote)

[19] The permit process can take up to a year at times. Another thing to note is that these permits were only valid for a year if the airline had not begun operations in the route. Permits would be subject to renewal in a year if the route was being utilized but became invalid if the airline didn’t operate the route.

[20] Only major airlines were flying the Bogota – Sao Paulo Route. These were: Copa Airlines, LATAM and Avianca

[21] https://www.larepublica.co/empresas/irelandia-aviation-incremento-su-participacion-y-es-la-nueva-duena-de-vivacolombia-2401596

[22] Viva Air Peru began operations in mid-2017.

[23] https://www.reuters.com/article/brief-aar-corp-enters-agreement-with-viv/brief-aar-corp-enters-agreement-with-viva-colombia-and-viva-air-peru-idUSFWN1J40DD

[24] http://www.financecolombia.com/declan-ryan-replaces-vivacolombia-founder-william-shaw-president-viva-air/

[/fusion_text][fusion_separator style_type=”none” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” sep_color=”” top_margin=”10px” bottom_margin=”” border_size=”” icon=”” icon_circle=”” icon_circle_color=”” width=”” alignment=”center” /][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]